UNDERSTANDING MASSACHUSETTS AUTO INSURANCE SELECTIONS PAGES:

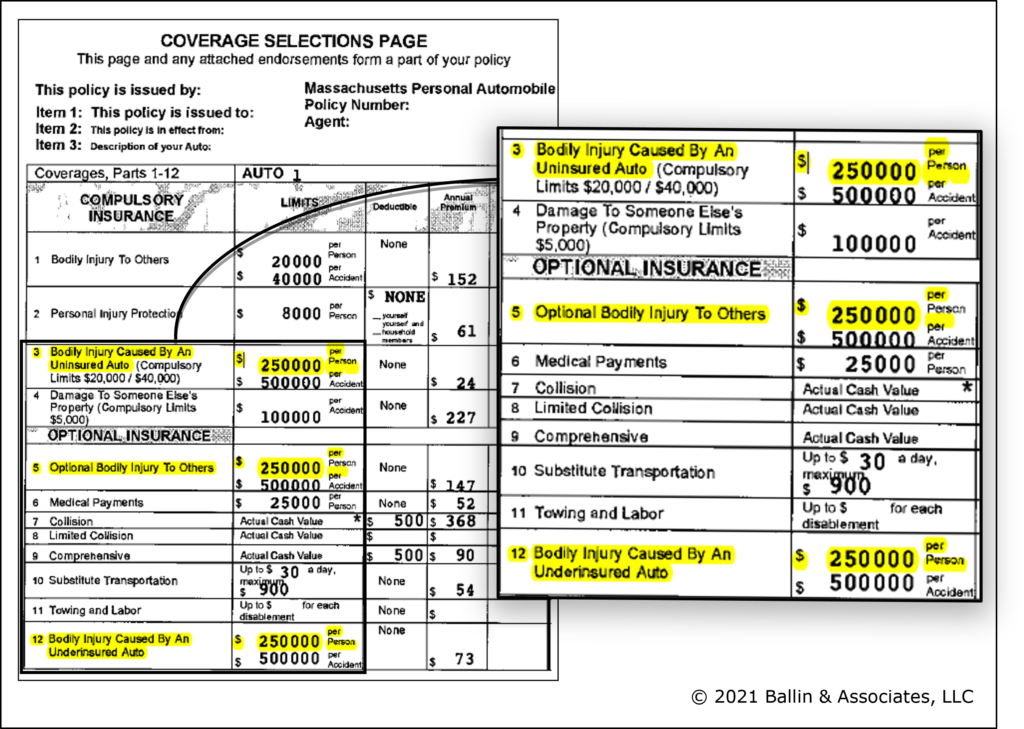

Does this picture look familiar? It should – it is a copy of a Massachusetts car insurance coverage selections page, and a good one to boot. We have highlighted three important “Parts”, which are often overlooked and, in our experience, not understood: Parts 3, 5, and 12. Find your personal car selections page and compare it with this example. If yours doesn’t look like the example, call your agent immediately to find out what it will cost to increase your current policy to what our firm considers to be a good example of “full” coverage.

I advise my clients to carry at least $250,000 per person/$500,000 per incident limits under Parts 3, 5, and 12. These are the highest limits some Massachusetts auto insurers will sell, so be sure to ask your agent if higher limits are available. Depending on your current policy coverages, the cost of increasing these Parts is often comparable to buying lunch or dinner. Please do not wait for your policy renewal date to make these changes — Call your insurance agent ASAP.

Over the years, we have been very successful making claims under these Parts. Fortunately, some of our clients had protected themselves by increasing these Parts before they suffered harms in a motor vehicle incident. On the other hand, unfortunately, many of our clients’ policy limits were too low or simply had no protection at all.

Here’s a quick summary of how some of the overlooked Parts of your car insurance protect you. For more information about how these and other Parts protect you, feel free to email or call me with any questions.

Part 3 – Injury caused by an UNINSURED auto coverage:

This Part is important when you are injured as a result of someone using or operating a car that does not have insurance. For example, a car with cancelled insurance or a stolen car are both considered to be an “Uninsured Auto”. If so, your car insurance will pay for your harms up to the amount of protection you purchase under Part 3. This case study article by Zachary Ballin, Esq. highlights the significance of Part 3 coverage.

Part 12 – Injury caused by an UNDERINSURED auto:

Many people are surprised to find they have little or no coverage under Part 12. When the driver that injures you does not have enough insurance to pay for all of your harms, they are considered underinsured. The amount of available coverage under Part 12 for such a loss is determined by subtracting the amount of coverage which the defendant driver has from the amount of Part 12 underinsured coverage which you have purchased. For example, if the defendant driver has the minimum $20,000 per person insurance coverage and you have purchased $250,000 per person underinsured, Part 12 coverage, there will be up to $230,000 available to compensate you for your harms and losses. Together with the $20,000 per person coverage which the defendant driver has in this example, you would have up to $250,000 available from a combination of the defendant’s insurance policy plus your own insurance policy. Here is an article by Attorney Richard Miller about a case where the client, a police officer, was fortunate to have increased his Part 12 coverage before suffering an injury-on-duty.

Part 5 – Injury to OTHERS:

You are not allowed to insure your car for more Part 3 Uninsured coverage and Part 12 Underinsured coverage than your car is insured for Part 5 Optional Bodily Injury to Others coverage. So, you will be required to also increase Part 5 Optional Bodily Injury to Others coverage to the same amount of your increased Parts 3 and 12 coverages.

For more information about how these and other Parts protect you, feel free to contact us or click this link to view a recorded webinar by Attorney Steve Ballin.