PERSONAL UMBRELLA POLICIES MAY NOW COVER INJURIES CAUSED BY NEGLIGENT MOTORISTS

A few years ago, I wrote about Arthur Vee’s case. Arthur was riding his motorcycle when he was cut off by a motorist who was turning left into a gas station. Arthur suffered horrific, permanent injuries to his leg. The defendant operator had $250,000 of coverage on his auto policy; however, I discovered after filing […]

$250,000 FOR OFFICER INJURED ON ROAD DETAIL WHO LEARNED A VALUABLE LESSON FROM A PRIOR INJURY

Officer Palmer had the minimum allowable limits on his auto insurance the first time he was injured-on-duty. Thankfully, he changed this before he was injured a second time… CRITICAL CHANGES TO MASSACHUSETTS AUTO INSURANCE POLICY It was a fall Sunday morning and Ms. Jones got a later start than she wanted on her drive to […]

$100,000 FOR OFFICER INJURED BY UNINSURED VEHICLE

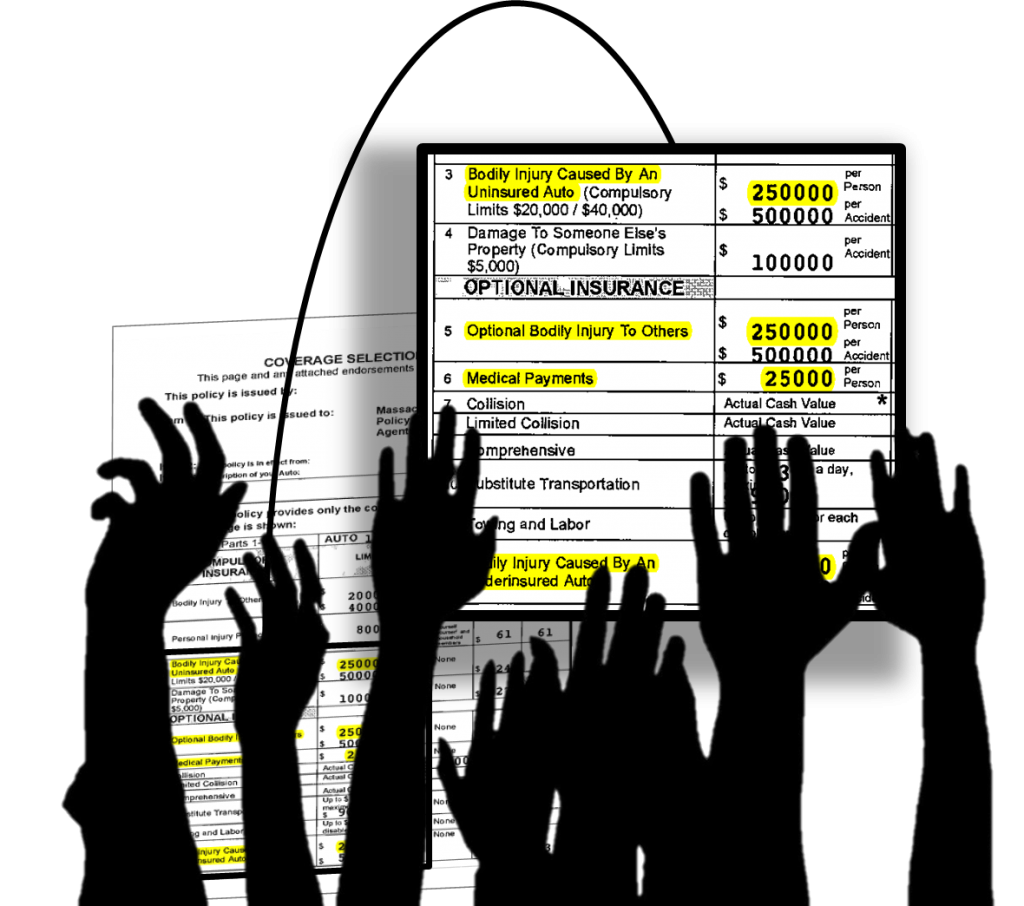

A simple fact: many officers are still unaware that their personal auto insurance provides coverage for on-the-job injuries caused by cars in a wide array of ways, such as pursuits, crashes during emergency responses, pedestrian strikes on a road detail, and during traffic stops, as you will see here. This coverage was especially important to […]

“Reserves”: Why Insurance Companies Don’t Want You To Know About Them

Someone rear-ends you. Now what? You spend the next couple of months getting your neck and back taken care of by a couple different physicians. Along the way you do not consider making a claim against The Other Guy’s Insurance Company, Inc. or calling a lawyer. After all, you ‘don’t want to hurt the other […]

“FULL” COVERAGE FAQ

FAQ: Should I increase the limits on all cars which I own? Yes, we recommend you do and here is why. Assume you own and insure two cars in your name. One car is insured with increased optional limits for Uninsured and Underinsured Motorist Coverages of $250,000 per person. Your other car is only insured […]

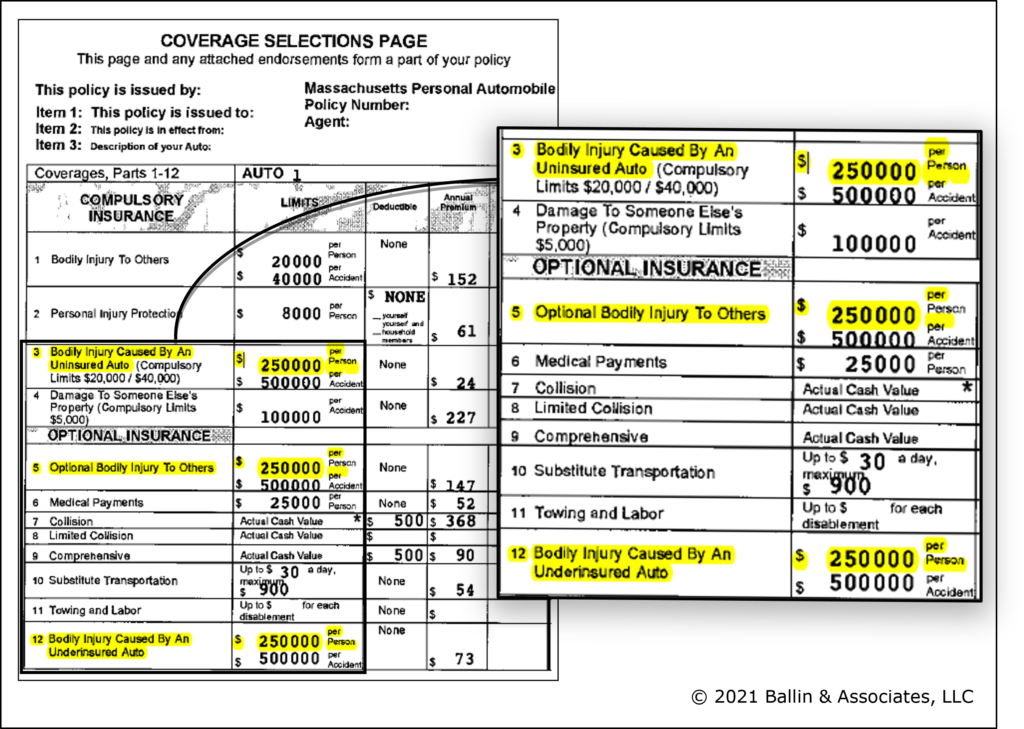

GOT “FULL” COVERAGE?

UNDERSTANDING MASSACHUSETTS AUTO INSURANCE SELECTIONS PAGES: Does this picture look familiar? It should – it is a copy of a Massachusetts car insurance coverage selections page, and a good one to boot. We have highlighted three important “Parts”, which are often overlooked and, in our experience, not understood: Parts 3, 5, and 12. Find your […]