$300,000 FOR OFFICER ATTACKED ON DUTY, SUFFERS PTSD

This case involves an all-too familiar scenario – the police are forced to handle a disturbed and out-of-control individual resulting in an injured officer. Drivers swerve around a young man walking around in a busy tunnel. Shirtless and covered in soot, the young man is in obvious need of help. A passing officer puts his […]

DON’T WORRY ABOUT PRIOR CONDITIONS

A police officer injured on duty can make a valuable claim against a negligent third party, even when the current injury involves a body part injured or operated on in the past or has been chronically problematic. It is not unusual for an officer to re-injure a back, shoulder, knee, wrist, or ankle during an […]

DOES FLO KNOW ABOUT THIS?

Progressive Insurance has one of the most visible advertising campaigns in the U.S. and promotes themselves as a top-notch insurance company committed to customer service at the highest level. But in the real world, Progressive sometimes employs a strategy that leaves its customers high and dry when they get sued. We are handling a case […]

I WAS IN A CRASH WHILE RIDING IN AN UBER CAR. WHOSE INSURANCE PAYS?

As the use of Uber becomes more and more common across the country, so do crashes involving Uber drivers. In that situation, will the driver’s personal auto insurance cover any injuries or property damage caused by the crash? In general, the driver’s personal auto insurance will not provide coverage for any “driving for hire” activities […]

$500,000 FOR INJURED EMPLOYEE FROM EMPLOYER WHO LET ITS WORKERS COMPENSATION INSURANCE LAPSE

A 55 year old worker suffered second and third degree burns to his foot at work while cleaning heavy equipment with a high pressure steam power washer. His employer had no workers compensation insurance at the time; the policy having been cancelled for non-payment of premiums months before. The employee hired us after months of […]

“Reserves”: Why Insurance Companies Don’t Want You To Know About Them

Someone rear-ends you. Now what? You spend the next couple of months getting your neck and back taken care of by a couple different physicians. Along the way you do not consider making a claim against The Other Guy’s Insurance Company, Inc. or calling a lawyer. After all, you ‘don’t want to hurt the other […]

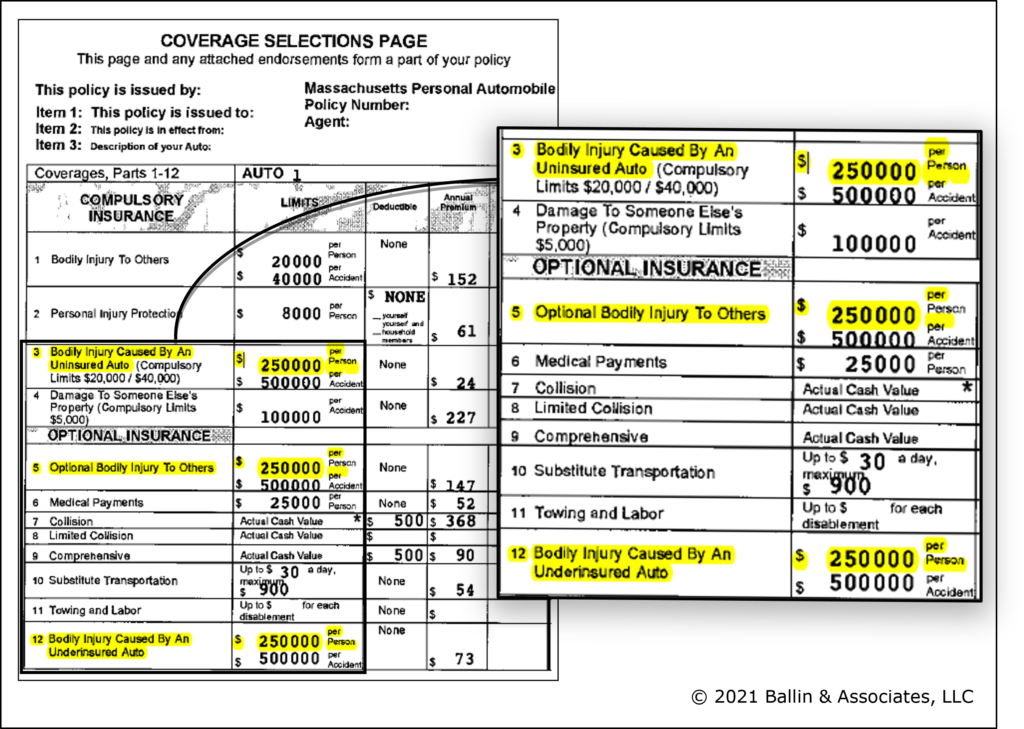

“FULL” COVERAGE FAQ

FAQ: Should I increase the limits on all cars which I own? Yes, we recommend you do and here is why. Assume you own and insure two cars in your name. One car is insured with increased optional limits for Uninsured and Underinsured Motorist Coverages of $250,000 per person. Your other car is only insured […]

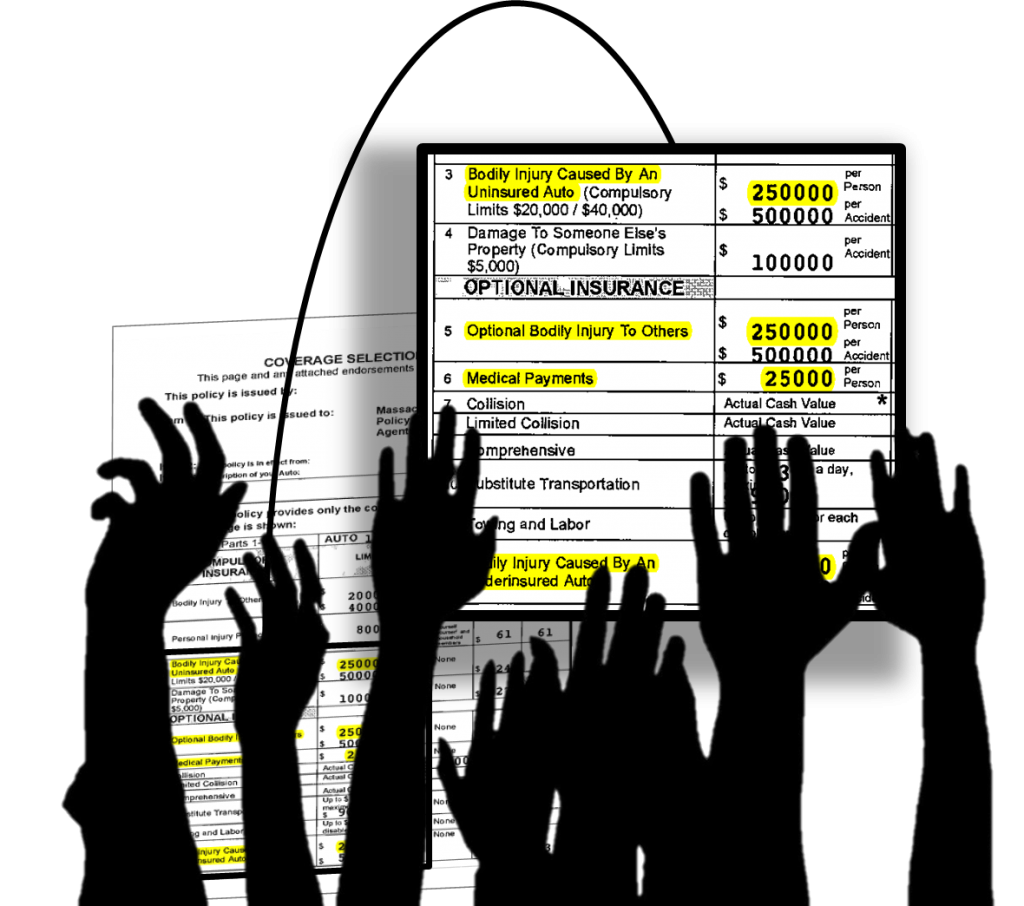

GOT “FULL” COVERAGE?

UNDERSTANDING MASSACHUSETTS AUTO INSURANCE SELECTIONS PAGES: Does this picture look familiar? It should – it is a copy of a Massachusetts car insurance coverage selections page, and a good one to boot. We have highlighted three important “Parts”, which are often overlooked and, in our experience, not understood: Parts 3, 5, and 12. Find your […]